IT due diligence is a critical aspect of the investment or acquisition process for a startup software company. It involves a comprehensive evaluation of the company's IT infrastructure, systems, processes, and data to identify potential risks, liabilities, and opportunities for improvement. Here are some key IT due diligence considerations that investors and acquiring companies are likely to focus on:

1. Infrastructure and Architecture:

- What is the current state of the IT infrastructure, including hardware, software, and network components?

- Is the infrastructure scalable and capable of supporting future growth?

- What cloud services and providers are being used, and what are the associated costs and contracts?

- Are there any single points of failure or other architectural risks?

By plugging your cloud accounts (AWS, Azure and GCP) into Hava, in a minute or so, you can easily demonstrate the state of your cloud architecture using automatically generated diagrams to any potential investors or companies performing acquisition due diligence.

The diagrams show the running resources, any load balancing strategies that are in place to handle increased network loads and any architecture redundancy in place designed to mitigate cloud vendor outages if say a single availability zone became unavailable due to a data center outage or natural disaster.

This means you can easily demonstrate your architecture and applications have some substance beyond a deck slide or roadmap bullet point, a critical step in cloud IT due diligence.

2. Traction and Growth History:

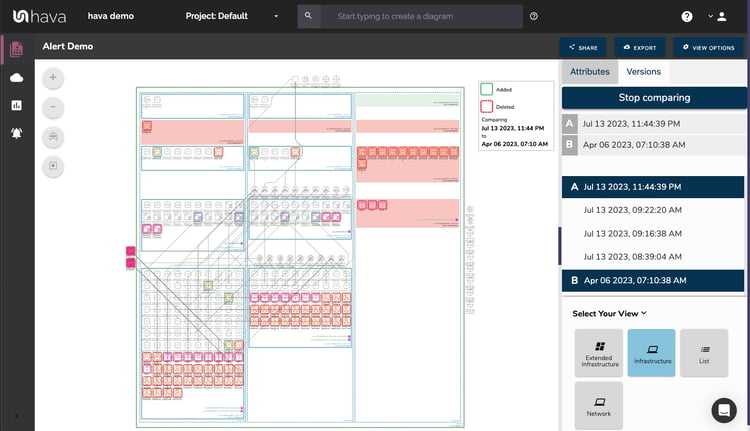

If you are later in the start up journey you may have already started to scale your architecture to respond to increased user demands and infrastructure traffic loads. This is nice to see from an investors perspective.

When you have Hava plugged into your cloud accounts, this growth is recorded in version history so at any point in time your can demonstrate your growth cadence with Hava diff diagrams drawn form any two dates.

3. Data Management and Security:

- How is data managed, stored, and protected?

- Are there any data privacy or security risks, and how are they mitigated?

- What are the data backup and disaster recovery processes?

- Are there any past or ongoing data breaches or security incidents?

You can easily demonstrate your cloud security stance by providing potential investors with security view diagrams generated by Hava showing how your security groups are configured, what resources they protect and how traffic can enter and exit your cloud architecture and over which ports and protocols that is possible, which means you can show your security is on point and there are no gaping holes in you security ready to be exploited.

4. Software and Applications:

- What software and applications are being used, and are they licensed appropriately?

- Are there any custom-developed applications, and if so, what is the quality of the code and documentation?

- Are there any dependencies on third-party software or services?

5. Compliance and Regulations:

- Is the company in compliance with all relevant laws, regulations, and industry standards, such as GDPR, HIPAA, or SOC 2?

- Are there any pending or past legal actions related to IT or data management?

Using Hava diagrams you can easily demonstrate the geographical location of your stored data via the visualisation of your cloud databases instances. If local compliance standards dictate data should be stored onshore, Hava diagrams will show investors or potential new owners where data is stored and replicated.

6. IT Operations and Support:

- What are the IT operations and support processes, and are they adequate for the current and future needs of the business?

- Are there any IT staffing gaps or skill deficiencies?

- What are the IT-related costs and budget?

7. Intellectual Property:

- Does the company own the intellectual property rights to its software and other key assets?

- Are there any potential IP conflicts or disputes?

8. Cybersecurity:

- What are the cybersecurity policies and procedures?

- Are there any past or ongoing cybersecurity incidents?

- What are the results of any recent cybersecurity assessments or audits?

9. Integration and Compatibility:

- How easily can the company's IT systems and data be integrated with those of the acquiring company?

- Are there any compatibility issues or other integration risks?

Using Hava to map both company's cloud IT infrastructure during a SaaS M&A project will often surface any potential problems or help inform the teams involved on the scale of the integration task.

10. Track changes before, during and after the transaction:

- Using Hava you can establish a baseline of what cloud architecture is running and can track material changes at any point of the due diligence process. This can be extremely beneficial when demonstrating that what the acquirer has agreed to purchase or the investor has agreed to invest in is in place and running when it comes time to settle the transaction.

Investors and acquiring companies will typically request various documents and artifacts as part of the IT due diligence process, such as:

- IT policies and procedures

- Network diagrams and architecture documentation

- Software and hardware inventory

- Data management and security policies

- IT-related contracts and agreements

- Intellectual property documentation

- Cybersecurity policies and incident reports

- Compliance documentation and audit reports

It is important for the startup company to be well-prepared for the IT due diligence process and to provide accurate and complete information to the investors or acquiring company.

This will help to build trust and confidence and increase the likelihood of a successful investment or acquisition.

Even if you aren't using Hava to automate your cloud documentation, you can hook up your AWS, Azure and GCP accounts to Hava and have the documentation you need in a couple of minutes.

Adding cloud architecture documentation to your investor pitch decks and M&A or acquisition deal room has never been easier.

Adding Hava into your cloud toolset now not only ensures you always have up to date documentation on hand, it also means you can start tracking the changes and growth of your cloud architecture and integrate the evidence of growth and scale into your product story and pitch decks, no matter how long the sale acquisition or merger process takes.

Find out more about Hava here: